Get the free certificate of insurance form

Show details

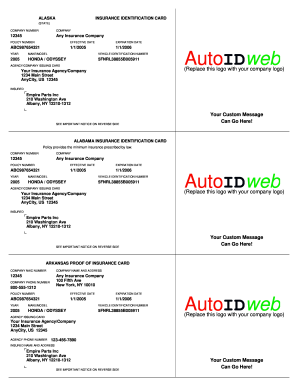

DATE (MM/DD/YYY)CERTIFICATE OF LIABILITY INSURANCE05/24/2018THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of insurance template form

Edit your certificate of liability insurance form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your blank certificate of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdf certificate of insurance form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit certificate of liability insurance template form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of insurance sample pdf form

How to fill out certificate of liability insurance:

01

Obtain a copy of the certificate of liability insurance form from your insurance provider. This form may be available online or you may need to request it directly.

02

Fill in the basic information, such as the name and address of the insured party. This typically refers to the individual or entity that purchased the insurance policy.

03

Include the policy number, effective dates, and expiration dates of the insurance policy. This information is crucial for identifying the specific coverage and confirming its validity.

04

Identify the insurance company providing the coverage and include their contact information. This allows the certificate holder (the party requesting the certificate) to verify the insurance information and reach out to the insurance company if necessary.

05

Describe the type and scope of liability coverage provided by the insurance policy. This may include general liability, professional liability, product liability, or any other specific types of coverage.

06

Specify the limits of liability, which refer to the maximum amount the insurance company will pay out for any covered claims. This is an important aspect for the party requesting the certificate as it gives them an idea of the insurance coverage's financial protection.

07

List any additional insured parties, if applicable. Sometimes, the certificate holder may require that they be added to the insurance policy as an additional insured. This provides them with some level of coverage under the policy.

08

Include any special endorsements or provisions that may be necessary. This could be specific requirements or terms that the certificate holder has requested, and the insurance policy has agreed to.

Who needs certificate of liability insurance?

01

Individuals or businesses engaging in activities that may cause bodily injury or property damage to third parties often need a certificate of liability insurance. This includes contractors, professional service providers, event organizers, and business owners.

02

Many clients or business partners may require proof of liability insurance before entering into any agreements or contracts. This ensures that they are protected in case of any unforeseen accidents or incidents related to the insured party's activities.

03

Landlords may often require tenants to provide a certificate of liability insurance before signing a lease agreement. This protects the landlord from liability claims arising from the tenant's activities on the property.

Overall, anyone engaging in activities where there is a risk of potential damage or injury to third parties should consider obtaining a certificate of liability insurance. It is important to consult with your insurance provider and understand the specific requirements and coverage needed for your particular situation.

Fill

certificate of insurance pdf

: Try Risk Free

People Also Ask about acord certificate of insurance fillable

What is the abbreviation for certificate of liability?

A certificate of liability insurance (COI), is a simple form issued by your insurance company. It includes the types of coverage, the issuing insurance company, your policy number, the named insured, the policy's effective dates, and the types and dollar amount of limits and deductibles.

What is the name for the certificate of liability insurance?

A certificate of liability insurance is a document that proves you have general liability insurance coverage. It is also called a general liability insurance certificate, proof of insurance or an 25 form.

Is a certificate of liability insurance the same as a declaration page?

If you need to show proof of auto insurance to the Department of Motor Vehicles or your lender, you may need a certificate of insurance. This document contains information similar to a declarations page but omits specific details that third parties don't need, such as your auto insurance premium.

What is another name for certificate of insurance?

A certificate of insurance (COI) is a document from an insurer to show you have business insurance. They're also known as certificates of liability insurance or proof of insurance.

What is an certificate of liability insurance?

An certificate of insurance is typically a one-page document summarizing key information about your business insurance policy. It is also known as an 25 certificate of insurance, certificate of insurance (COI) or a certificate of liability insurance.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in insurance certificate template without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your blank certificate of insurance form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I fill out fillable certificate of insurance on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your certificate of liability insurance form pdf. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit blank acord certificate of insurance on an Android device?

You can edit, sign, and distribute certificate of insurance fillable on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is certificate of insurance?

A certificate of insurance is a document that provides proof that an individual or organization holds an insurance policy. It outlines the types of coverage, limits, and the period during which the coverage is effective.

Who is required to file certificate of insurance?

Typically, businesses, contractors, or service providers are required to file a certificate of insurance when requested by clients, stakeholders, or regulatory bodies to demonstrate proof of insurance coverage before starting work or a contract.

How to fill out certificate of insurance?

To fill out a certificate of insurance, you need to include details such as the name of the insured, insurance company name, policy numbers, types of coverage, policy limits, effective dates, and any certificate holder's information if applicable.

What is the purpose of certificate of insurance?

The purpose of a certificate of insurance is to serve as evidence of insurance coverage, reassure clients or parties that potential risks are covered, and facilitate the smooth operation of contracts or agreements by confirming that certain insurance requirements are met.

What information must be reported on certificate of insurance?

The information that must be reported on a certificate of insurance includes the name and address of the insured, insurance provider, policy number, types of coverage, policy limits, effective dates, and sometimes additional clauses such as waivers of subrogation or additional insured status.

Fill out your certificate of insurance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blank Certificate Of Insurance Template is not the form you're looking for?Search for another form here.

Keywords relevant to business insurance form

Related to certificate of liability insurance fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.